504 LOAN LIMITS

Higher 504 Loan Limits Available For Manufacturers and Green Energy Projects

Are you an SBA borrower that is running up against the SBA exposure limits of $5,000,000?

If you are a manufacturer or can meet one of SBA’s Green Public Policy Goals, you can access additional funding under the 504 program.

SBA Loves Manufacturers!

Every year, more and more manufacturers are using the SBA 504 loan program to secure financing for their business expansion and equipment projects. Business owners can take advantage of the 504 loan to free up cash flow to preserve it for working capital, along with fixed, affordable interest rates. But there are other significant benefits, too, that the SBA allows for manufacturers:

- Any manufacturer with a NAICS code starting with 31, 32, or 33 is eligible for up to $5,500,000 in SBA financing per project – only our portion of the financing (no cap)

- This can include real estate, FF&E (no rolling stock), or a mix of the two

- Debenture term is dependent on the useful life of the majority of the assets financed

- Lender does not need to match debenture term

- Can include installation costs

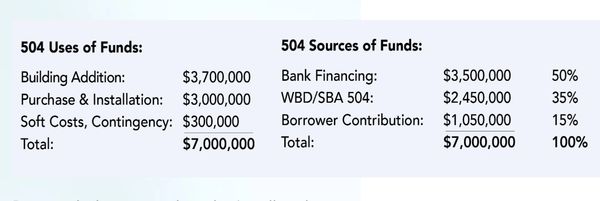

We recently financed a project with a manufacturer looking to purchase both existing facilities as well as purchase an extrusion line for their primary manufacturing facility. A couple of years later they had plans for a large CAPEX project. The structures are shown in the table.

SBA Loves Green Energy Projects!

If your borrower meets the criteria for green energy policy goals, they can also increase their SBA 504 loan limit. The criteria includes:

- 10% reduction in existing energy consumption (new facility or retrofit of existing facility)

- 15% of energy from renewable energy sources

- Either goal needs to be supported by an energy study

Green Project Loans are capped at $16,500,000 in aggregate exposure (debenture amounts) under the Green Program with $5,000,000 also available under the regular 504 program.

WBD has experience in using the SBA 504 loan with the Green Program. In a recent project, our borrower had already utilized the 504 program twice in the past decade, both to construct and expand the real estate. They were then looking to expand their facility a second time to accommodate their growing needs. Their total SBA 504 exposure at the time was $4,500,000, which wouldn’t have left much room for their new $7,000,000 project under the normal exposure limits.

Because the borrowers elected to install a solar power system, it provided an estimated annual energy savings of 15%. And as a result, they were able to access additional SBA exposure above and beyond the normal $5,000,000 limit. In addition to the on-going energy savings, the borrowers were able to finance the solar power system into the 504 project (at cost), which provided an additional incentive to invest in green energy.

As you can see, the SBA offers manufacturers additional benefits, and has essentially eliminated any exposure limits. This can be a great way for a manufacturer to grow their business or keep their working capital position strong during uncertain economic times. Though not as common, green energy can also be a tool to increase your borrower’s exposure limits.

By continuing to use this site, you accept our use of cookies and this disclaimer:

Due to the sensitivity and the nature of these professional services, no specific mentions of companies or individuals are made to protect the beneficiaries from legal infringements. Content is designed to avoid plagiarism and the need for citations. No content is copied in its "as-is" format to eradicate any potential copyright infringements globally through international laws and in all international jurisdictions. Disclaimer: Licensed with Series 6 & 63. I do not provide individualized investment advice or fiduciary portfolio management. Alternative investments and lending products discussed may be illiquid, carry risk, and are not suitable for all investors.

All Rights Reserved.

Cookie Policy

This website uses cookies. By continuing to use this site, you accept our use of cookies and this disclaimer:

Due to the sensitivity and the nature of this professional service, no specific mentions of companies or individuals are made to protect the beneficiaries from legal infringements.

Content is designed to avoid plagiarism and the need for citations. No content is copied in its "as-is" format to eradicate any potential copyright infringements globally through international laws and in all national jurisdictions.